Source: Bank of America

Bank of America says it's channeling $4 billion of its 2025 technology budget into AI and other new tech initiatives, representing almost a third of its $13 billion annual tech spend. The move builds on the bank’s experience with AI since 2018, when it launched the virtual assistant Erica, and demonstrates how democratizing consumer access to ML is reshaping global operations.

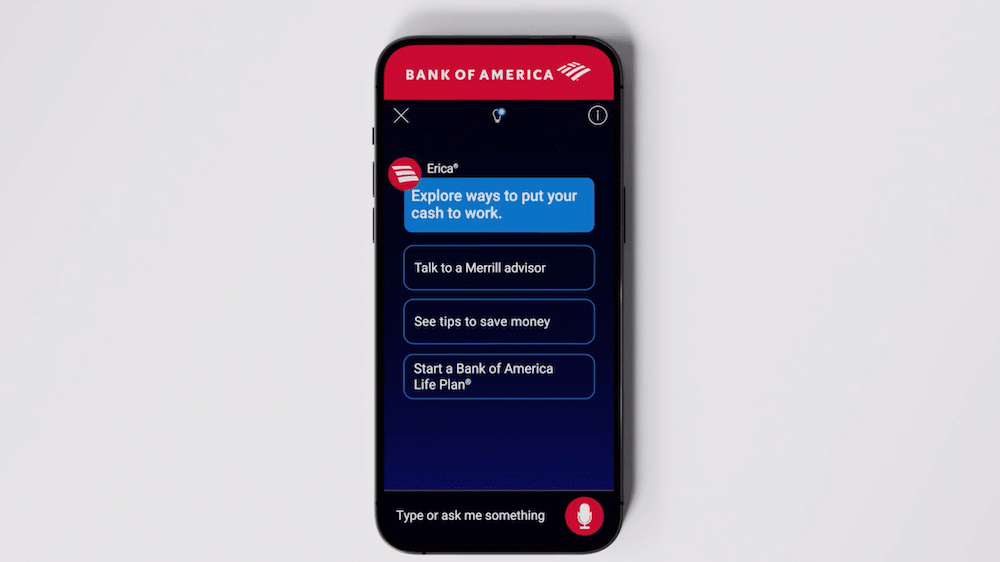

Employee efficiency: Internally, BofA's AI adoption first took off in 2020 with Erica for Employees, which now helps over 90% of Bank of America’s 213,000 staff and has cut IT support calls by 50%. Customer-facing services, trading desks, and training programs also incorporate AI, boosting efficiency, speeding up service, and increasing personalization.

According to the bank, its suite of Gen AI tools powers the transcription and summarization of call center conversations and fuels a coding assistant that raises developer productivity by 20%. The efforts are part of a broader technology strategy that has led to a reported 2.5 billion Erica interactions.

Thousands of hours of 'busywork' have been eliminated, enabling employees to refocus on client problem-solving and strategy. The Academy, the bank’s professional development program, uses AI-driven conversation simulators to enhance training and encourage more customer engagement.

AI governance in focus: As AI broadens into more processes, Bank of America says it's prioritizing rigorous oversight and clarity—particularly in regulated environments handling sensitive financial data. The bank publicly states that human oversight, transparency, and accountability remain central to its approach.